Sep 8, 2014 by Eric Martin

Why a 13-Year-Old Strategy Makes Apple A Great Company

Apple’s share price has been on a rapid ascent, having regained nearly all the value it lost in 2013, helped in large measure by stock buy-backs. Those who feel the stock is currently over-valued should consider that the company’s P/E Ratio has, in fact, been hovering around its five-year average.

As always, the question one must ask is whether the current valuation judged by share price truly reflects the long term value of the company based on it strategic foundation and capacity to execute.

Last year, as APPL’s share price was losing luster, I wrote the following piece:

As has been widely reported, sales of Apple’s iPhone have come under assault by terrific devices from companies like Samsung running Google’s Android OS. Though market share has held up in the US, interlopers are stealing the show outside North America. To read the news, Apple’s brand is losing its luster and, along with it, the company its lofty valuation.

Even an Apple fan has to acknowledge that iOS, introduced in 2007, is showing its age. Maybe it’s a matter of familiarity making the heart go wander. Maybe it’s the customization of Android or the bold, graphic live tiles of Window Phone 8. Somehow, as easy as it is to use, the iPhone feels just a touch dated.

For many fanboys, this doesn’t matter much. Even a child relying on intuition can operate the iOS. The iPhone rarely misbehaves. Oh, and there are the 700,000+ industry-leading applications that are the lifeblood of the device’s attraction.

But what really sets Apple apart from its competitors isn’t the stunningly well-designed hardware. It’s the ecosystem that connects all Apple devices through the cloud. For some of us, our first experience with the Apple ecosystem dates back to 2001 with the purchase of the original iPod. The brilliance of that device wasn’t simply the terrific industrial design, but the software that made buying and using music easier than ever before. The strategy upon which that first Apple music player was built is over 13 years old. Yet the importance of the ecosystem that was its foundation remains one of the company’s biggest assets.

Sure, one can download music from Amazon and apps from Google. With a little effort you can even coordinate devices while getting work done using Google Docs. But somehow, it just never seems as easy—as magical—as Apple.

Add to that an installed base of hundreds of millions of iTunes users, over 200 million of whom use the service through the cloud, and you have a massive, sticky infrastructure. If you have bought in to the Apple world-view, dismantling your services and recreating them on a series of new devices is simply a lot to ask. And, you are unlikely to be able to transfer some of your content at all (playlists pose quite a challenge for some people.)

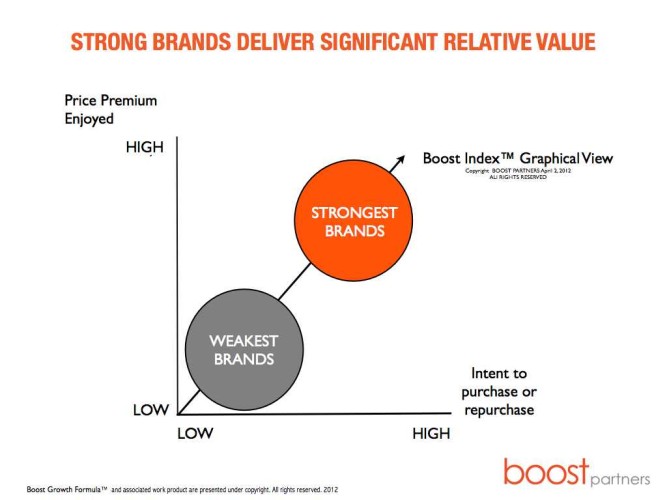

So, Apple needs a refresh. Its products are not winning the day internationally. But, Apple should not be written down—much less written off. It remains a global leader in profitability. Its brand is ranked next to Coke as the world’s most powerful. And, with hundreds of millions of credit cards having been registered with iTunes (I can even buy products at an Apple store today using that account without ever speaking with an Apple employee), it stands poised to reshape the world of digital commerce.

In short, Apple doesn’t have forever to reach a new level of innovation. But it does have plenty of time and cash to get there.

On the eve of Apple announcing a new round of products—possibly the most exciting set of devices in years including the addition of a new form-factor, the iWatch—keep in mind that Apple’s power has never rested on devices alone. Rather, it is the foundation of an ecosystem developed over a decade ago that gives the company its power…and its great future value. Tomorrow, as captivating as it will be to see sexy, shiny hardware, what will grab my attention is whether Apple manages to disrupt the dollar bill.

Eric Martin is the founder of 80amps for Enterprise and 80amps for Startups (a consultancy and incubator, respectively) and the Director of the University of Richmond’s Innovation and Entrepreneurship Program. Eric can be reached at eric@80amps.com. Follow eric on twitter @eeeemartin and Linkedin http://www.linkedin.com/pub/eric-martin/a/2bb/970/

View this article on LinkedIn here.